In a year of major UN Summits on development finance, sustainable development goals (SDGs) and climate change, the topic that has dominated the discussions has been on the role of the private sector and the finance that it can provide and finance that can be channelled through it.

This is clearly controversial with some groups arguing that no development finance should go through the private sector, while others see it as the panacea to “crowd-in” as much private sector involvement as possible.

Whichever side you’re on (or somewhere in the middle), one thing is clear – that the role of the private sector is likely to increase significantly in all forms of development in the forthcoming years, and certainly within the lifetime of the new SDGs.

Within this debate, perhaps the main challenge is to make sure that all private sector involvement contributes towards sustainable development, that it doesn’t undermine a country’s own capacity to meet its development needs and that it doesn’t contribute to any negative impacts, such as on human rights or the environment.

However, under current arrangements, this is far from easy and is far from the reality, as shown by the case of funds channelled through the European Bank of Reconstruction and Development (EBRD) to a Mongolian mining company that has caused pollution, loss of livelihoods and displacement of herders in Western Mongolia.[1]An excellent report this week into the World Bank’s lending arm, the IFC, catalogues a series of negative impacts on communities and the environment due to lack of oversight and poorly applied due diligence requirements.

Whereas clear principles have been developed for the use of government aid (ODA), the same level of attention hasn’t been paid to other types of public finance, in particular where it has been used to leverage private sector money. There are various safeguards and project criteria, but these have often been poorly applied and tend to take a do-no-harm approach as opposed to aiming for a positive contribution to sustainable development.

One of the main challenges in this area is the different expectations and incentives driving the public and private sectors.

Donors we interviewed recognised that this is a new area and that their thinking around impact and accountability is still emerging.

The need for a new approach

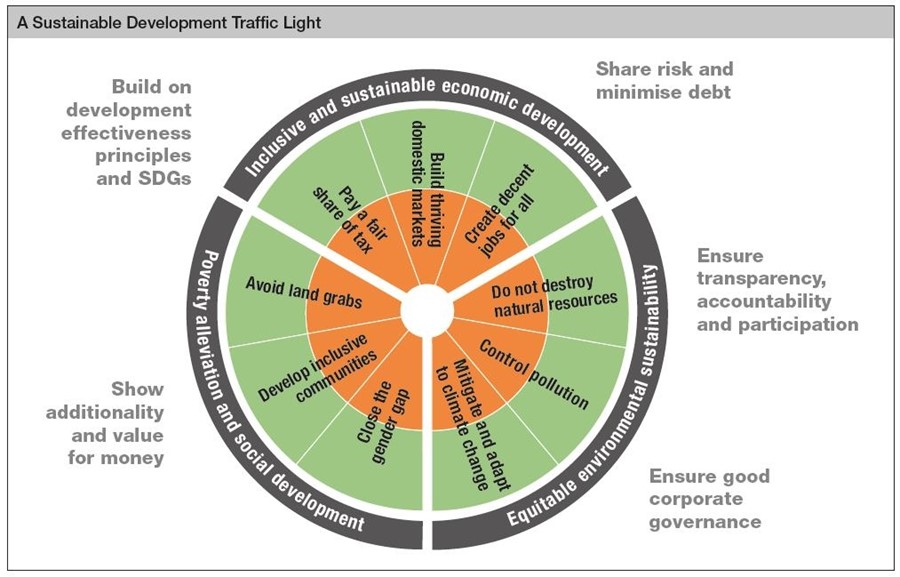

Drawing on existing practice and experience on the ground, safeguards, global standards and legally-binding principles, a group of development agencies has developed a proposal for all governments to apply sustainable development principles to all projects where public finance is used in conjunction with private finance.

The principles would be used in both project and programme design and implementation as well as any monitoring and accountability mechanisms.

This would ensure that all finance is targeted towards sustainable development outcomes, improve transparency and accountability for use of public funds, and enable a coherent approach across all forms of development finance.

The diagram above, in the form of a sustainable development traffic light, shows the main principles and the paper gives more details. All feedback is welcome as we work with government, business and civil society groups to further refine the proposal.

[1] http://bankwatch.org/news-media/blog/guest-post-mongolian-herders-file-complaint-ebrd-about-mongolian-iron-ore-company; and EBRD complaint: http://bit.ly/1wXEoCy ; and Steinweg and Schuit (2014) Impacts of the Global Iron Ore Sector. Somo, Amsterdam, Netherlands. And When the dust settles, Somo

Article written by Graham Gordon, first published on the CAFOD policy blog here.

Contact person: Graham Gordon, Head of Public Policy, CAFOD (ggordon(at)cafod.org.uk)

CAFOD is CIDSE’s member in England and Wales.